News

RipplesMetrics: Nigeria may end 2020 worse than it started, and it’s not only about COVID-19

Holiday season is coming at the worst possible time for millions of Nigerians.

Already, it’s been an economic calendar to forget and things look like they’ll get worse in the run-up to December 31st.

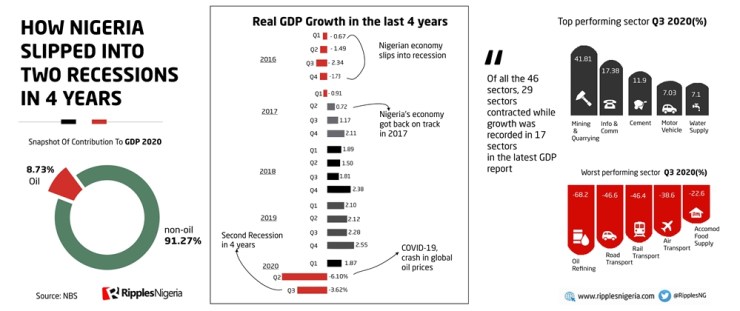

On Saturday, 21st November, the National Bureau of Statitics announced Nigeria economy was in recession, slumping by 3.62% in second quarter of 2020. The country had earlier recorded a negative 6.10 per cent growth in the second quarter.

The recession announcement follows October inflation figure of 14.25 per cent, the highest in the last 30 months.

While the latest GDP figure was expected, considering the snail-like scenario growth since 2016, Nigerians will be hoping the government economic policies will help the country exit as quickly as possible, and also keep to its promise of projected 6 percent growth in its 2021 proposed budget.

A cursory look at GDP figures shows Nigeria had the best growth quarter on quarter, an outstanding +12.1% QoQ GDP Growth rate and improving from -6.10% in Q2 2020.

However, trying to make sense of the improvement will be a little harder to coming out of recession itself.

A closer inspection of the figures shows where the country missed it and spells doom for millions of Nigerians.

Of all the 46 sectors, 29 sectors contracted while growth was recorded in 17 sectors. Trade sector which not only accounts for 15% of the economy growth but also employs millions of Nigerians was badly hit.

An unpalatable storm heading to the end of a torrid year, when added to the rising food prices, with October inflation figure of 14.25 per cent representing the highest in the last 30 months, and 21.7 million unemployed population.

Read also: RipplesMetrics… Every month Nigeria will pay N68.5 billion for due external debt in 2021

NBS had earlier reported in its COVID-19 impact report for the month of August 2020 that many households have had to take out loans to meet their pressing financial obligations with majority reporting it was food.

The trade sector (wholesale and retail), in real terms, year on year growth stood at –12.12%, which was –10.67% points lower than the rate recorded the previous year (Q3 2019), but 4.46% points higher than in the preceding quarter at –16.59% growth rate.

Trade’s contribution to GDP was 13.88% lower than the 15.23% it represented in the previous year, and the 14.28% recorded in 2020.

Explaining the Scenario, Kala Aja a financial analyst tweeted, “Recession?What does it mean? Imagine a bakery making Agege bread, They buyFlour SugarYeastPay salaryPay taxesDeposit cash in bank, banks use that deposit and creates loans. An econony built by Agege bread Ioaf cost N50, output 1000 so “GDP” is N50 x 1000 =N50,000″

“Then crisis, and people lose jobs. Instead of buying one Agege bread and day, they buy one every two days. So bakery sells less bread, instead of 10,000 loaves they sell 5000So “GDP” is N50 x 500 = 25000 A 50% fall in output of Agege bread.”

“What happens? Well less Agege bread output means less flour bought less sugar bought Less salary paid Less cash deposited So Agege industry states to infect other sectors like banking. Those sectors also cut down on spending, pay less workers…a vicious cycle starts

“In summary, a recession is normal business cycle, but if you do bad policies (like closing border) you make Agege bread expensive to produce so the loaf price goes from N50 to N150 Again this makes the bread expensive and reduces sales and cycle starts again”

How Nigeria will exit this recession which experts have considered to be worst than that of 2016 remains to be seen but one thing is certain, Nigeria needs a plan.

By Dave Ibemere…

Join the conversation

Support Ripples Nigeria, hold up solutions journalism

Balanced, fearless journalism driven by data comes at huge financial costs.

As a media platform, we hold leadership accountable and will not trade the right to press freedom and free speech for a piece of cake.

If you like what we do, and are ready to uphold solutions journalism, kindly donate to the Ripples Nigeria cause.

Your support would help to ensure that citizens and institutions continue to have free access to credible and reliable information for societal development.