News

SPECIAL REPORT: Empty ATMs, long queues as banks sell new notes, frustrate Nigerians

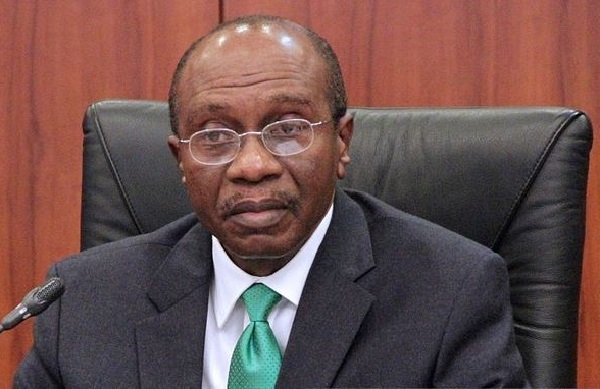

Hours after the governor of the Central Bank of Nigeria, (CBN) Godwin Emefiele announced a 10-day extension of the initial 31 January deadline for the collection of old notes on Sunday January 29, Ikechukwu Samuel walked into a First Bank branch in Enugu state and deposited his old naira notes.

Afterwards, he proceeded to the automated teller machine (ATM) area of the bank to withdraw the new notes but he got the response, “temporarily unable to dispense cash, do you want to perform another transaction?

Disappointed but still hopeful, he visited other bank branches, including First City Monument Bank, (FCMB), Access and Fidelity banks. By 5pm, he had already visited more than seven bank branches within the Enugu metropolis. But none of them gave him the new notes, or even the old one he had deposited earlier for that matter.

Samuel planned to use the money to settle his sick mother’s hospital bills. He had tried to make a transfer which failed due to poor network. Now, he is confused as to what to do.

“If I knew, I would have kept my old naira notes since the new ones are not available,” a distraught Samuel said. “Now, I can’t even withdraw the old notes”. I will have to go and keep trying to make a transfer”.

Samuel is only one out of millions of Nigerians who have their monies deposited in banks but cannot withdraw, following the redesign of the naira notes.

For almost an hour, Pregnant Joy Chimezie tried to withdraw money from the automated teller machine (ATM) area of the Zenith Bank located at presidential road, Enugu. But the message remained the same: Temporarily unable to dispense cash.

Earlier in the day, she visited several banks within the metropolis, including United Bank for Africa and Access Bank located at the University of Nigeria, Enugu Campus, (UNEC) and Fidelity bank at Rangers Avenue but could not withdraw.

She is tired but needs the money for business.

“I will wait, she said, her hand wrapped around her chest. “But It is sad because the ordinary citizens often bear the brunt of these policies.”. “I have money in my account but cannot withdraw”.

These days, it is common to see Nigerians waiting on long queues, hoping to withdraw the new notes. Sometimes, they fight to get their money. Sometimes, they spend the entire day and return home without the notes.

The redesign

Last October, the CBN announced that it would redesign the N200, N500 and N1,000 denominations of the naira, with January 31 as the deadline for the return of the old notes to the banks.

At the unveiling of the new naira notes at the State House on November 23, 2022, the CBN Governor, Emefiele told journalists that the January 31 deadline was sacrosanct. He had said that the redesign was intended to among other things, make the country’s monetary policy decisions more efficacious and support the efforts of security agencies in combating banditry and ransom taking from Nigerians.

As the deadline approached, pressure was mounted on the CBN for a review of the policy and the extension of the deadline, especially given that the new notes were not in circulation yet.

Speaker of the House of Representatives, Femi Gbajabiamila even threatened to issue a warrant of arrest on Emefiele and some bank directors over their refusal to appear before the green chamber over the scarcity of the new naira notes and the January 31, 2023 deadline.

Having sought and obtained approval from President Buhari, Emefiele announced an extension of the deadline from January 31 to February 10 to allow for the collection of more old notes legitimately held by Nigerians and achieve more success in cash swap in rural communities.

The CBN governor also announced a 7-day grace period, beginning on February 10 to 17 in compliance with sections 20(3) and 22 of the CBN Act allowing Nigerians to deposit their old notes at the CBN after the deadline when the old curreny would have lost its legal tender status.

But while the deadline has been extended, there yet remains a problem of unavailability of the new notes across ATMs in Nigeria. While some marketers collect the old notes, especially with the extension of the deadline and given that that is the only way they can make sales, others insist on the new ones.

To confirm the widespread unavailability, this journalist visited four banks within the Enugu metropolis, including First Bank, presidential road; Zenith Bank, presidential road; First City Monument Bank, (FCMB) off presidential road and Access Bank, Ogui road.

On arrival, it was noticed that the various points which normally would have long queues were empty. While the Zenith and First bank branches have six and four ATM points respectively, FCMB and Access banks have 3 ATMs each. As at 5 pm on Sunday, none of the machines in these banks was dispensing money to people who had come to make withdrawals.

This reporter also tried to withdraw from each of the machines but got the same response: “temporarily unable to dispense cash, do you want to perform another transaction?.

At Access Bank, Ogui road, one of the security officers said that the ATMs paid in the morning hours and stopped.

Banks allegedly selling new notes

While the new notes remain scarce at ATMs points, they have been sited at various social gatherings, further confirming allegations that banks were selling the notes to high-net-worth customers, also known as priority customers or currency traders who allegedly pay extra when withdrawing large amounts of the redesigned naira notes.

This January, a twitter user shared a video that captured moments when a certain man was spraying bundles of mint new naira notes at a party. The video sparked concerns among Nigerians who wondered about the fate of the ordinary following the redesigned notes.

Bundles of scarce new notes sprayed at a social gathering.

On Monday, January 30, another Twitter user shared a video showing moments when a group of men and women were throwing bundles of the scarce new noted at another party.

“It amounts to economic sabotage and efforts must be made to find out where the disconnect is and those behind it punished, said Segun Ajibola, a Professor of Economics at the Babcock University, Illisan, Ogun State on a programme on Arise TV.

Scarce new notes being sprayed at a social gathering.

Implications for economy

Senior Analyst at SBM Intelligence, Gloria Oscar said that the negative implications of the redesign include: Counterfeiting risk, reduced access to financial services, particularly for people in remote or rural areas, loss of value as people who are unable to exchange their old notes in time will lose the value of their savings, increase in black market activities.

Others include disruption of economic activities as businesses and consumers are being forced to temporarily stop transactions while they cannot access the new currency, decrease in spending because people hold on to their cash until they are confident in the stability of the new notes.

“The redesign also creates confusion and uncertainty among the public, particularly those less familiar with online banking”, she said, adding, “Banks also face logistical difficulties because people rush to exchange their old notes simultaneously, leading to long lines and congested banks”.

Commercial banks blame CBN for inadequate supply

As the public accuses commercial banks of selling the new notes, sources familiar with operations of the CBN accuse the apex bank of inadequate supply of the notes which makes it difficult for them to meet customers’ demands.

A source who prefers not to be mentioned was quoted as saying that banks were receiving an average of N12 million in some parts of the country, an amount the source said was grossly inadequate to meet operational demands.

“Cash needed for ATM operations alone in this place is about N25m, and that’s apart from other cash transactions within the bank,” the source said. “Bankers are scared to complain openly.”

Another bank manager told the paper that while his branch usually needs about N10 million to enable ATMs dispense cash to customers, they only got N2 million of the new note for an entire week which explains why the machines could not dispense money to customers.

READ ALSO:SPECIAL REPORT: UBEC projects executed by lawmaker, others cripple education in Sokoto

Banks have since been ordered not to use the old notes.

In his statement on Sunday, Emefiele said that the CBN had received reports of breaches by some bank branches. He however assured that the bank had agreed with executive chairmen of the EFCC and ICPC to assist by sending their staff to all CBN and DMB branches nationwide to join in monitoring the implementation of the guidelines.

Billions outside banking industry

In a statement on the progress on implementation of the new redesigned currency on January 29, Emefiele said that while currency circulation had risen to N3.23 trillion as at October 2022 from N1.4 trillion in 2015, only N500 billion was within the banking industry and N2.7 trillion held permanently in people’s homes.

He however noted that since the commencement of the program, the bank has collected about N1.9 trillion while about N900 billion remain outside the banking industry.

“We are happy that so far, the exercise has achieved a success rate of over 75 percent of the N2.7 trillion held outside the banking system, “he said. “Aside from those holding illicit/stolen naira in their homes, for speculative purposes, we aim to give all Nigerians that have naira legitimately earned the opportunity to deposit their monies for exchange”.

EFCC, DSS arrest traders selling new notes, bank officials fingered

On Monday, January 30, the Economic and Financial Crimes Commission (EFCC) announced the arrest of members of a syndicate who were trading the redesigned naira notes around zone 4 and Dei Dei axis in Abuja.

In a statement by EFCC spokesperson, Wilson Uwujaren, the suspects said that they were working in connivance with some commercial bank officials.

Uwujaren said that the operation followed intelligence on activities of unscrupulous currency speculators who were exploiting desperate citizens by offering them the new Naira notes for foreign currencies at below the going rate.

“The Commission will extend the operation to all the major commercial centres of the country until all the syndicates involved in the illegal trade are demobilised,” he said, adding, that “Financial system operators are also warned to desist from the sharp practices or risk arrest and prosecution”.

The Department of State Services (DSS) had during operations across the country, arrested some Nigerians involved in the sale of the new naira notes. Its public relations officer, Peter Afunanya said in a statement that some commercial bank officials were aiding the act.

The DSS warned that the Service had ordered its Commands and Formations to ensure that all persons and groups engaged in the illegal sale of the notes were identified, calling on appropriate regulatory authorities to step up monitoring and supervisory activities to expeditiously address emerging trends.

N200 per N1000 new note

Apart from banks that have been accused of doing business with the new notes, others who seem to be benefitting from the scarcity are owners of Point of Sale (POS) businesses who now charge exorbitant amounts for withdrawals.

Previously, to withdraw N10,000 in the costs only N100. Now it costs N2000 to withdraw the same amount. That is, N200 per N1000. Some of those who spoke to this reporter say they charge as much as N300 for N1000 because of the difficulty in getting the new notes.

Nelson John runs a POS business in Enugu. To make withdrawals, he leaves home as early 5am every morning and sometimes, when he gets to the machine, he finds people already queuing up and waiting for their turns.

“Sometimes, you have only one bank that gives the new notes, “he said. “It is affecting business because the highest you can withdraw is N20000 per day, you cannot even use more than one card,”. The old notes are not even available”.

Sometimes, he spends N10,000 to get N100,000 from an individual who according to him, buys the new notes from bank officials and sells to individuals.

Individuals struggle to get money at an ATM

Accusations, counter accusations over naira redesign

The decision by the CBN to redesign the N200, N500 and 1,000 banknotes has ruffled many feathers. This January, presidential candidate of the ruling All Progressives Congress (APC), Asiwaju Bola Tinubu told a crowd of APC supporters at the party’s presidential campaign rally in Abeokuta, the Ogun state capital that the naira redesign and fuel scarcity were intended to sabotage his victory at next month’s election.

Last November, Chairman of the Economic and Financial Crimes Commission, Abdulrasheed Bawa, was quoted as saying that there was no political motive behind the idea. Rather, it was intended to have hidden funds returned.

At the apex bank’s sensitisation event and old notes swap in Ekiti, the Director of Finance at the CBN, Benjamin Fakunle, had also said that the redesign was not targeted at any politician or political party but in the interest of the nation.

CBN pledges to ensure new notes get to citizens

In his statement, Emefiele had assured that the bank had held several meetings with its deposit money banks, (DMBs) and provided them with guidance notes on processes they must adopt in the collection of old notes and distribution of the new notes to all Nigerians.

These, according to the statement, includes specific directives to the DBMs to load new notes into their ATMs nationwide to ensure that an equitable/transparent mechanism for the distribution of the new notes to all Nigerians.

Emefiele said that the bank has also deployed 30,000 super agents nationwide to assist in the cash swap initiative in the hinterlands, rural areas and regions underserved by banks In the country to ensure that the weak and vulnerable ones can swap/exchange their old notes.

For Oscar, the redesign will enhance financial Inclusion and a cashless economy as well as stress out bandit and terrorist groups.

However, efforts must be made to ratify the shortages in the weeks leading up to the election because if it continues, “the government may be forced to still consider the old notes valid”, SBM’s Oscar said.

By Arinze Chijioke

Join the conversation

Support Ripples Nigeria, hold up solutions journalism

Balanced, fearless journalism driven by data comes at huge financial costs.

As a media platform, we hold leadership accountable and will not trade the right to press freedom and free speech for a piece of cake.

If you like what we do, and are ready to uphold solutions journalism, kindly donate to the Ripples Nigeria cause.

Your support would help to ensure that citizens and institutions continue to have free access to credible and reliable information for societal development.