Ripples Metrics

RipplesMetrics: Nigerian banks earn big returns from e-transactions, as e-payments surge 613%

Nigerian banks are experiencing a period of growth, and it is expected to continue in the coming months.

The volume of financial transactions performed electronically by Nigerians has reached an all-time high, thanks to the Central Bank of Nigeria’s cashless policy drive.

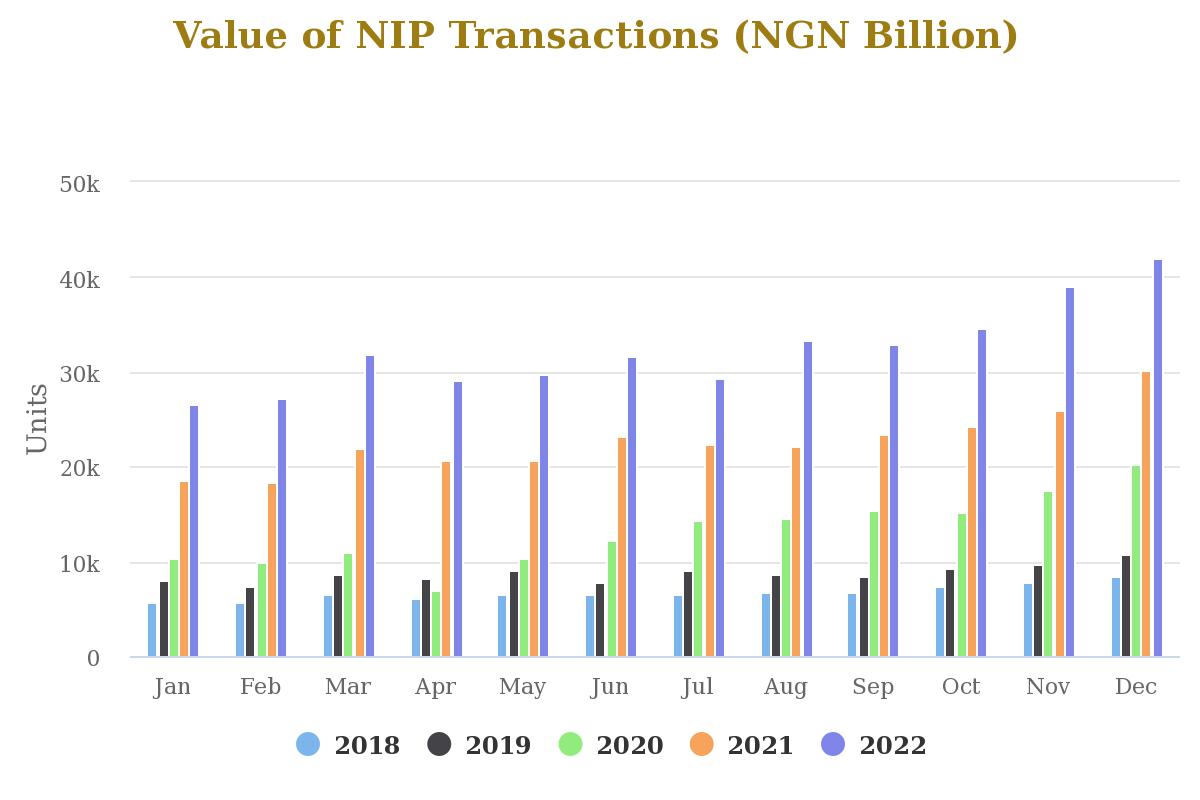

According to new data from the Nigeria Inter-Bank Settlement System (NIBSS), the total volume of NIBSS Instant Payment platform (NIP) transactions has increased by 613.1 percent to 5.2 billion in 2022, compared to 729.2 million recorded in 2018.

Its value also increased by 381.5 percent from N80.4 trillion as at 2018 to N387.1 trillion in the same period of last year.

One sector of the economic that is benefitting from the rising number of e-payments is the banking sector.

Checks on the financials of 12 Nigerian banks listed on the Nigerian exchange show a surge in electronic revenue which include account maintenance charges, fees and commissions.

For example, Nigerian banks raked in from account maintenance alone the sum of N109.31 billion in nine months of 2022, which indicates a 17 percent increase from N93.46 billion in the corresponding period of 2021.

The banks surveyed include Zenith Bank, Access Holdings, GTCO, FBN Holdings, UBA, FCMB, Fidelity Bank, Stanbic IBTC, Sterling Bank, Union Bank, Wema Bank, and Unity Bank.

Here is a breakdown of the banks’ financials

Zenith Bank

Zenith Bank’s account maintenance fee increased to N28.14 billion in the nine months of 2022, 16.3 percent from N24.2 billion in the nine months of 2021.

The bank’s fees on electronic products climbed to N36.07 billion in the nine months of 2022, up 50.3 percent from N24 billion in the corresponding period of 2021.

Net income on fees and commission moved up to N100 billion, a 27.7 percent increase from N78.3 billion in the comparable period.

Zenith Bank’s gross earnings rose to N620.5 billion in the nine months of 2022, up 19.6 percent from N518.6 billion in the nine months of 2021.

Access Bank

Access Bank’s account maintenance charge and handling commission stood at N18.7 billion, a 15.4 percent increase from N16.2 billion in the nine months of 2021.

Channels and other E-business income for Access Bank rose to N49.4 billion, 7.4 percent from N46 billion in the reviewed period.

Fee and commission income grew by 17.6 percent to N133.5 billion in the nine months of 2022 from N113.5 billion in the nine months of 2021.

Net interest income grew 5 percent to N280.5 billion from N267.6 billion in the comparable periods.

Guaranty Trust Holding Company (GTCO)

The bank’s account maintenance charges amounted to N15.9 billion, a 22 percent increase from N13.02 billion in September 2021.

E-business income dropped 3 percent to N15.18 billion from N15.67 billion in the reviewed period.

Fee and commission income stood at N66.94 billion, an 18.2 percent increase from N56.6 billion in the nine months of 2021.

GTCO’s net interest income stood at N189.7 billion, a 16.4 percent increase from N163 billion in the comparable period.

FBN Holdings

FBN Holdings’ account maintenance income amounted to N13.15 billion from N11.74 billion, indicating 12 percent increase year on year.

The bank’s electronic banking fees dipped 5 percent to N40 billion in the nine months of 2022 from N42.02 billion in the nine months of 2021.

The bank’s fee and commission income surged to N110.8 billion, a 7 percent increase from N103.7 billion in the nine months of last year.

FBN Holdings’ net interest income surged by 53 percent to N249.5 billion from N163 billion in the comparable period.

United Bank for Africa (UBA)

UBA’s account maintenance fee stood at N9.64 billion in the nine months of 2022, a 35.6 percent increase from N7.11 billion in the nine months of 2021.

The bank’s electronic banking income rose to N48 billion, a 14.3 percent increase from N42 billion in the reviewed period.

Fees and commission income grew by 24.3 percent to N138 billion from N111 billion in the comparable period.

UBA’s net interest income stood at N282.5 billion in the nine months of this year, indicating a 23 percent increase from N229.2 billion in the same period of 2021.

FCMB

FCMB’s account maintenance surged by 46 percent to N4.96 billion, from N3.4 billion in the nine months of 2021.

The bank’s electronics fees and commissions climbed 2 percent to N10.14 billion from N9.9 billion in the comparable period.

READ ALSO:Ripplesmetrics: Nigeria’s key economic trends, as Buhari’s aides label Obasanjo failure (2)

Gross fee and commission income stood at N34.6 billion, a 35 percent increase from N25.6 billion in the reviewed period.

FCMB’s gross earnings increased to N200 billion in the nine months of 2022, up 34 percent from N149.4 billion in the nine months of 2021.

Fidelity Bank

Fidelity Bank’s accounts maintenance charge stood at N3.56 billion in the nine months of 2022, a 21 percent increase from N2.94 billion in the nine months of 2021.

The bank received a commission on e-banking activities worth N2.24 billion, down 7.4 percent from N2.42 billion in the reviewed period.

Total fees and commission income jumped 15 percent to N25.04 billion from N21.76 billion in the comparable periods.

Gross Earnings rose to N241.9 billion in the nine months of 2022, 38.8 percent from N174.3 billion in the nine months of 2021.

Stanbic IBTC Holdings

The holding company saw its account transaction fees drop 6 percent to N3.55 billion from N3.77 billion in the nine months of 2021.

Electronic banking income increased by 35.5 percent to N1.63 billion in the nine months of 2022 from N2.53 billion in the nine months of 2021.

Fee and commission revenue surged to N72.4 billion, an 11.4 percent increase from N65 billion in the comparable period.

Stanbic IBTC Holdings’ net interest income stood at N79.6 billion, a 47.4 percent increase from N 54 billion in the period reviewed.

Sterling Bank

Sterling Bank account maintenance fee stood at N2.94 billion, up 43.4 percent from N2.05 billion in the nine months of 2021.

E-business commission and fees amounted to N5.56 billion in the nine months of 2022, indicating a 11 percent increase from N5.01 billion in the same period of 2021.

The bank’s fees and commission income rose to N19.84 billion, a 15 percent increase from N17.28 billion in the reviewed period.

Sterling Bank’s net interest income stood at N54.5 billion, a 14.2 percent increase from N47.7 billion in the comparable periods.

Union Bank

Union Bank account maintenance fee was worth N2.15 billion in the period ended September 2022, up 29.5 percent from N1.66 billion in the nine months of 2021.

The bank’s e-business fee income stood at N5.68 billion in the nine months of 2022, a 15.7 percent decline from N6.74 billion in the corresponding period of 2021.

Fees and commission income dropped to N12.6 billion, a 7.3 percent decrease from N13.6 billion in the reviewed period.

Union bank’s gross earnings increased by 13 percent to N141.5 billion in the nine months of 2022 from N125.3 billion in the nine months of 2021.

Others

Unity Bank

Unity Bank ranked after the top ten banks with an account maintenance revenue which dropped 8 percent to N1.13 billion from N1.24 billion in the reviewed period.

The bank’s e-banking income climbed 22.6 percent to N2.71 billion in the nine months of 2022, from N2.21 billion in the nine months of 2021.

Fees and commission income grew 17 percent to N5.33 billion, from N4.56 billion in the comparable period.

The bank’s gross income rose to N42.2 billion in nine months of 2022, 16.5 percent from N36.2 billion in nine months of 2021.

Wema Bank

Wema Bank’s account maintenance fees stood at N1.98 billion in nine months of 2022, a 32 percent increase from N1.5 billion in the same period of 2021.

The bank’s fees on electronic products increased to N2.55 billion in the nine months of 2022, a 45 percent increase from N1.76 billion in the corresponding period of 2021.

Total fee and commission income increased by 37.7 percent to N12.01 billion from N8.72 billion in the reviewed period.

Wema bank’s gross income grew to N95.34 billion in nine months of 2022, 51 percent from N63.07 billion in the nine months of 2021.

Join the conversation

Support Ripples Nigeria, hold up solutions journalism

Balanced, fearless journalism driven by data comes at huge financial costs.

As a media platform, we hold leadership accountable and will not trade the right to press freedom and free speech for a piece of cake.

If you like what we do, and are ready to uphold solutions journalism, kindly donate to the Ripples Nigeria cause.

Your support would help to ensure that citizens and institutions continue to have free access to credible and reliable information for societal development.